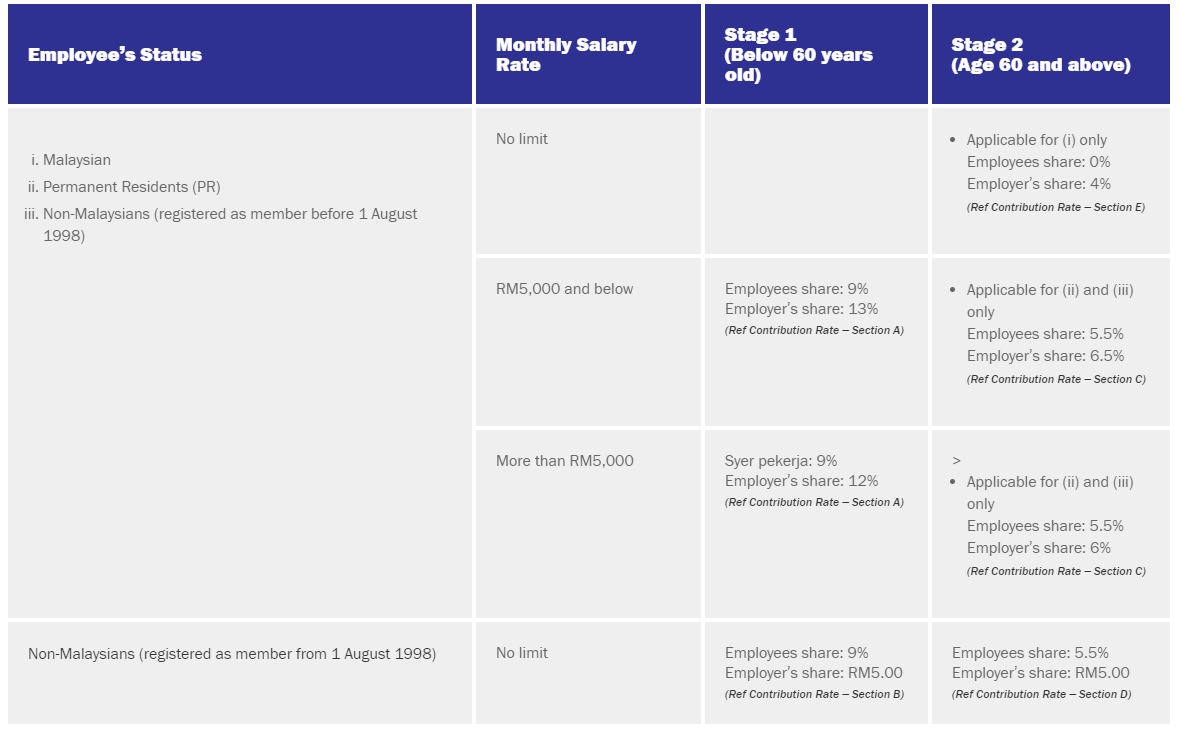

Monthly Contribution Rate Third Schedule The latest contribution rate for employees and employers effective July 2022 salarywage can be referred in theThird Schedule EPF Act 1991. This measure was subsequently extended several times and.

Epf Change Of Contribution Table Ideal Count Solution Facebook

Monthly Salary Rate.

. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF. In addition the EPF contribution rate is vary according to your monthly salary rate. Permanent Resident PR 3.

Employees Pension scheme AC 10. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

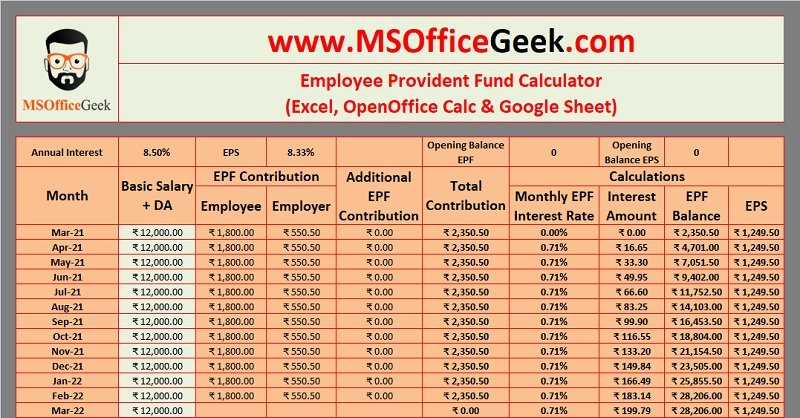

The amount paid is calculated at 05 of the employees monthly earnings according to 24 wage classes as in the contribution table rates below along with. Please note that the EPF contribution rate and the amount must be calculated by EPF calculator and EPF table based on the contribution rate specified in the Third Schedule of the 1991 EPF Act instead of using an exact percentage. The following table shows the EPF interest rate for the 10 years.

These are the compulsory contribution as. On 30 June 2022 the Employees Provident Fund EPF announced that the employees contribution rate below 60 years old is now 11 effective from July 2022 s salary and contribution starts from the month of August 2022 onwards. Lets have a view of table here.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. An employee can choose to pay a higher rate if the employer is not under any objection to pay higher rates. 110 Employees Deposit Link.

Following the Budget 2021 announcement employees EPF contribution rate for all employees under 60 years old is reduced from 11 to 9 by default from February 2021 contribution to January 2022 contribution. Employees Deposit Link Insurance Scheme EDLIS 050. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector.

Employees Provident Fund Admin Charges. Non-Malaysians registered as member. A employees who are Malaysian citizens.

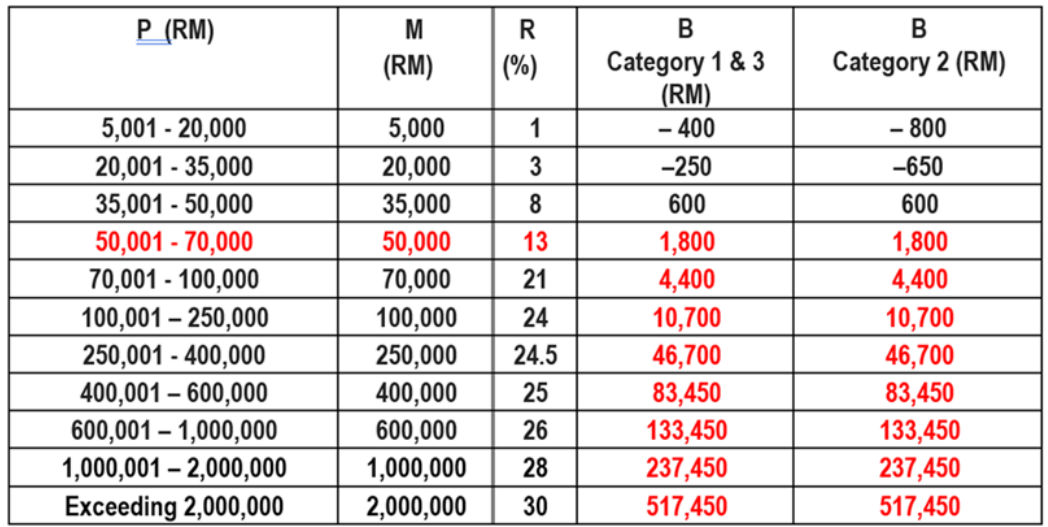

Jadual pcb 2020 pcb table 2018 epf contribution third schedule socso table. PCB EPF SOCSO EIS and Income Tax Calculator 2022. PF contribution rate is the significant contribution from employee income.

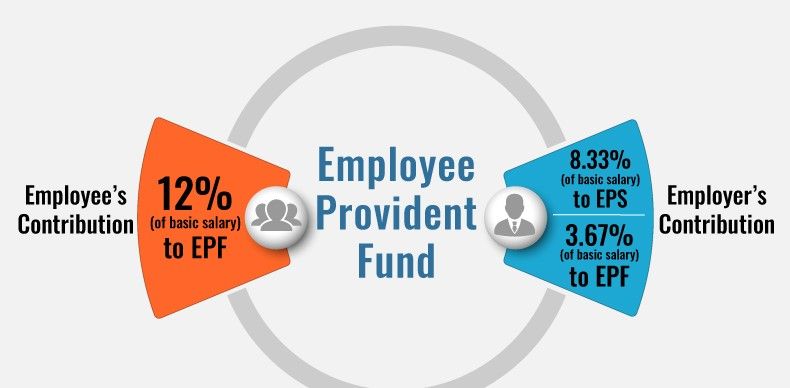

Employee provident fund AC 1 12. The EPF contribution rate for the financial year 2021 is 85. The current EPF interest rate for the Financial Year 2021-22 is 810.

Employee contributes 9 of their monthly salary. Employers are required to remit EPF contributions based on this schedule. For employees with monthly wages exceeding RM20000 the employees contribution rate shall be 9 while the rate of contribution by the employer is 12.

Stage 1 Below 60 years old Stage 2 Age 60 and above 1. The interest rate is decided after discussion between the Central Board of Trustees of EPFO and the Ministry of Finance at the end of every financial year. Employees Provident Fund EPF 367.

Please click here for. Monthly salary greater than RM5000. KWSP - EPF contribution rates.

In order to give people more disposable income the government announced during the epidemic a reduction in the monthly contribution rate to the Employees Provident Fund from 11 to 7 and 9. Moreover the interest is calculated monthly but transferred to the Employee Provident Fund account only on 31st March of the applicable financial year. Pcb calculator payroll epf socso eis and tax calculator.

EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. Given below is a list of interest rates of some of the previous years-. EPF Interest Rates History.

The present EPF interest rate is 865 and calculation of interest relies on the salary of the employee and on the share of employer contribution to PF. The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty years. The monthly EPF contribution rate of 9 will end on June 30 and will return to 11 in July.

The standard practice for EPF contribution by employer and employee are. Employees Pension Scheme 1995 replacing the Employees Family Pension Scheme 1971 EPS Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. Employer contributes 12 of the employees salary.

EPF contribution rate shown in the EPF table does not apply to foreigners registered as EPF members before August 1 1998. 9 of their monthly salary. B employees who are not Malaysian citizens but are.

For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table. The table for 2021 employee and employer EPF contribution rate. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

In the table given below the percentage contribution of the various categories has been summarized. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. Employees Pension Scheme EPS 833.

Employees aged 60 and above.

New Statutory Contribution Rate Of 2021 9 Or 11

How To Calculate Epf Bonus If Employee S Wages Less Than 5k But Bonus Wages More Than 5k Qne Software Sdn Bhd

India Payroll What Is Employee Provident Fund Epf And Employee Pension Scheme Eps How It Is Calculated In Deskera People

What Is The Epf Contribution Rate Table Wisdom Jobs India

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Contribution Rate Table Urijahct

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Download Employee Provident Fund Calculator Excel Template Exceldatapro

How To Calculate Interest On Your Epf Balance Mint

How Epf Employees Provident Fund Interest Is Calculated

Epf Challan Calculation Excel 2021

20 Kwsp 7 Contribution Rate Png Kwspblogs

Employee Provident Fund Calculator Excel Template Msofficegeek

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Epf Contribution Rates 1952 2009 Download Table